Who We Serve

Cable Hill Partners brings a wealth of financial expertise, experience and professional designations. We practice and serve under the fiduciary standard, the highest legal and ethical benchmark standard in our industry.

Our specialty is understanding the unique challenges and opportunities of the people we advise. Our professionals specialize in working with the following clients:

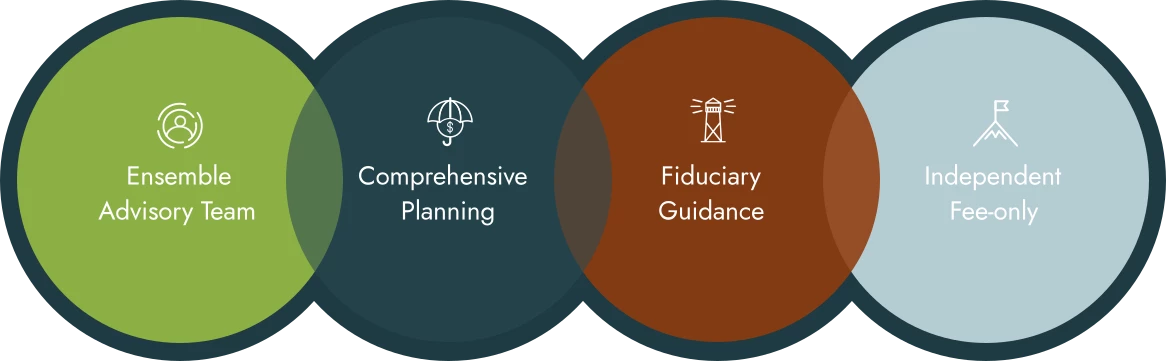

Our difference starts with higher standards

At Cable Hill Partners, we constantly ask ourselves what “great” looks like to continuously improve the way we help people clarify their values, fulfill their goals and elevate their lives.

Meet more of the team

129