Proactive Management

An experienced guide to keep you on course

When we talk about ‘elevating financial clarity,’ we mean far more than mere transparency. It’s how we strive to give our clients advice at a higher level, driven by a proactive service model that keeps us looking ahead to ensure their financial security.

Integrated planning

Your wealth, well-managed

We’ll coordinate all aspects of your financial plan, in concert with your other trusted professionals, to ensure there are no gaps and everything runs smoothly. With Cable Hill Partners, you’ll have full access to objective advice from subject matter experts as well as the powerful resources of our industry partners.

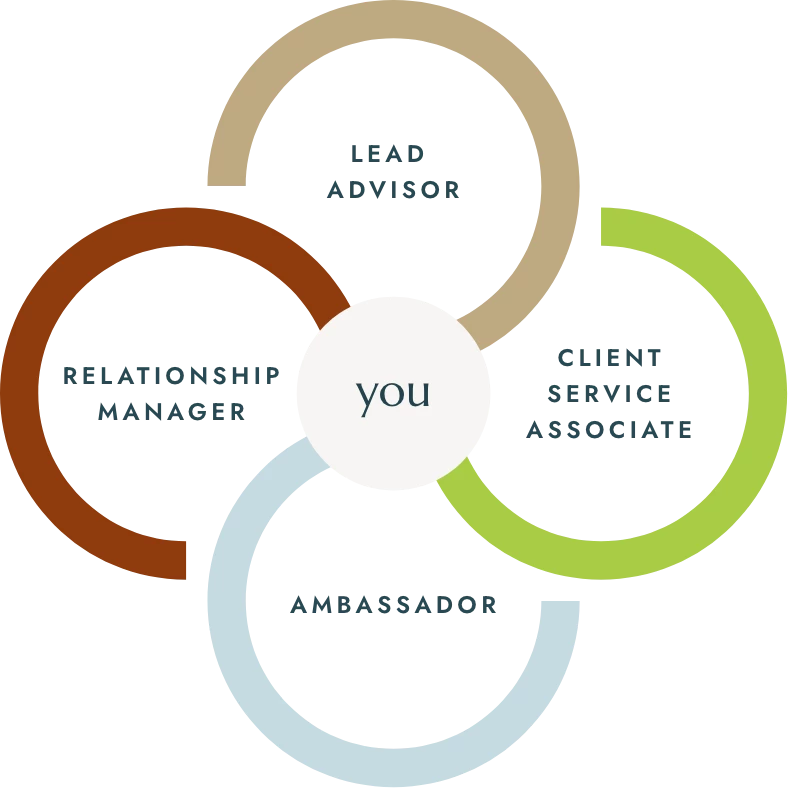

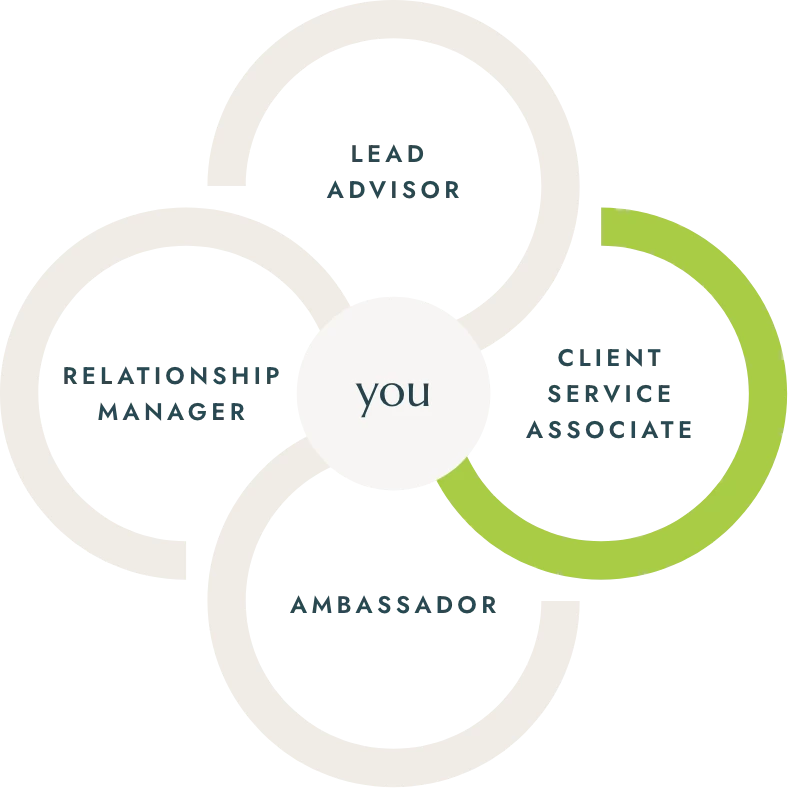

Next Level Client Care

Service in abundance

You have money to invest. Time, maybe not so much. Our full-service, client-centered approach means we take care of everything so you can continue to build your wealth while you enjoy your life. Save time thinking about your finances and spend it on the things that make you happy.

We’d love to meet you